Soroka — Market Signals & Automation Platform

Soroka is a distributed, event-driven backend platform for real-time cryptocurrency market analysis, signal generation, and post-event performance analytics. The system focuses on data pipelines, anomaly detection, and automated feedback loops rather than direct execution.

System Overview

The platform is designed as a set of independent Python microservices communicating through a shared database and Redis-based event queues.

The system continuously scans the cryptocurrency market, detects structural anomalies, generates filtered signals, and evaluates their post-event performance.

Market Data Ingestion

A Python backend built with FastAPI performs minute-level API requests to Binance, scanning the top 150 trading pairs by liquidity.

- Market snapshots are fetched every minute

- All database operations are fully asynchronous

- Historical data is preserved for comparative analysis

Analytical Microservices

Independent Python microservices analyze incoming market data in near real-time.

- Comparison of current and historical market states

- Detection of market structure anomalies (e.g. BOS events)

- Metric calculation and confidence scoring

- Persistence of analytical results

Each analytical component can be tuned or scaled independently.

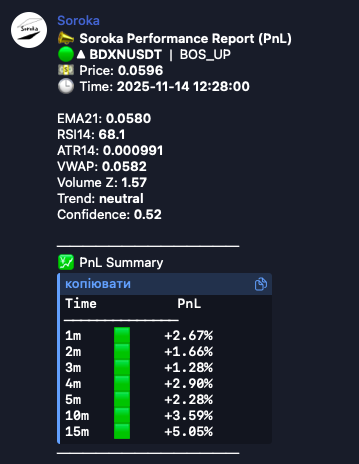

Signal Pipeline

When a detected event satisfies predefined filtering rules, the system generates a market signal.

- Signals are enriched with computed metrics

- Published to a Redis queue

- Consumed by Telegram broadcaster and/or trading bot

Redis acts as a decoupling layer between analytics, notification, and execution.

Post-Signal Performance Analytics

Each signal is automatically evaluated after publication.

- PnL calculated at 1, 2, 3, 5, 10, and 15 minutes

- Purely analytical evaluation (no execution required)

- Results reported to Telegram channel

This feedback loop allows continuous validation of signal quality.

Configuration Philosophy

All system behavior is controlled via .env files

on a per-microservice basis.

- No container rebuilds required for tuning

- Fast experimentation with detection logic

- Clear separation between code and strategy

Default Configuration (Excerpt)

# Event filtering

EVENT_FILTER_TYPE=BOS_UP

CONFIDENCE_MIN=0.45

CONFIDENCE_MAX=0.80

# Market structure detection

INTERVAL=1m

LOOKBACK=3

MIN_CANDLES=5

BOS_STRENGTH_THRESHOLD=1.006

MIN_VOLUME_MULTIPLIER=1.3

REQUIRE_BODY_RATIO=0.6

MIN_EVENT_INTERVAL_MINUTES=2

# Risk & analytics parameters

ALLOCATION_PCT=0.50

STOPLOSS_PCT=0.08

LEVERAGE=1

TRADE_TIME=90

# Liquidity & volatility filters

MIN_LIQUIDITY_USDT=10000000

MAX_VOLATILITY=0.25

MIN_TRADE_COUNT=300000

# Infrastructure

REDIS_URL=redis://redis:6379/0 # internal Docker network

TRADE_QUEUE_NAME=trade_bot_queue

MAX_SIGNAL_AGE=60

Output & Distribution

Validated signals are published to the Telegram channel Soroka signals

The same signal stream can be consumed programmatically by automated trading components.

Engineering Focus

- Event-driven architecture

- Asynchronous data pipelines

- Config-driven behavior

- Post-event analytics and feedback loops

- Operational transparency